by Andreas Hoffmann

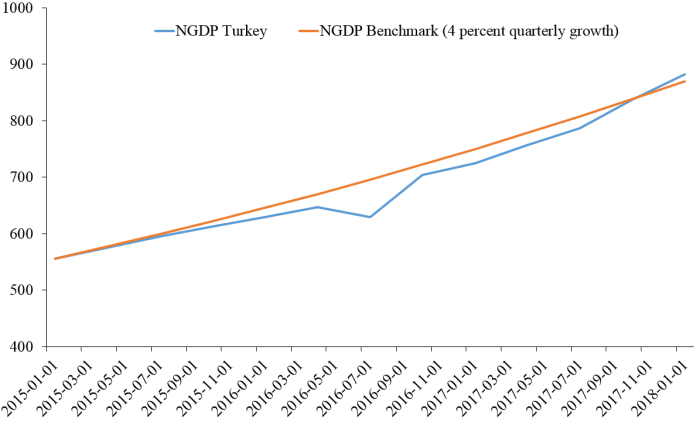

These days many commentators suggest that in Turkey a recession is on the way. But nominal GDP has continued to grow along trend.

Market monetarists, Keynesians, and some Hayekians believe that NGDP targeting could have prevented major recessions in the U.S. and in Europe following the 2008 financial crisis. To this end, central banks should have stabilized nominal GDP along its trend when the crisis unfolded. Believing in the power of monetary policy, proponents of NGDP targeting have criticized ECB and Fed policies for being too restrictive: The ECB should have responded much sooner and intervened more heavily in markets to counteract the decline in NGDP. The Fed has managed surplus liquidity inadequately.

Now we have got a new chance to collect insights into the potential benefits of NGDP targeting. Looking at Turkey’s development of NGDP, these Fed and ECB critics should be rather pleased. The data reveals no severe deviation from trend. At the moment, inflation is up and the New Turkish Lira (YTL) is losing value. But despite the pressure on the YTL, Turkey’s central bank lifted rates less than expected to maintain low borrowing costs and prevent a recession.

That’s what an NGDP-targeting central bank should be doing, right? From this perspective, we shouldn’t be worried about what’s going to happen in Turkey. It’s all good?

I am being a bit mischievous, I know.

But perhaps this episode provides evidence that John Taylor has got it right: NGDP targeting is not a panacea after all.

Data: Organization for Economic Co-operation and Development, Current Price Gross Domestic Product in Turkey [TURGDPNQDSMEI], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/TURGDPNQDSMEI, August 15, 2018.

———————–

Update: Graph with benchmark (quarterly growth of 4 %)

Data: Organization for Economic Co-operation and Development, Current Price Gross Domestic Product in Turkey [TURGDPNQDSMEI], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/TURGDPNQDSMEI, August 15, 2018.

John Taylor isn’t the only economist who believes that NGDP targeting is not a panacea, all competent economists hold that view.

I agree. But that was not the point. As you know all too well, Taylor spoke out explicitly against NGDP-targeting as he does not believe in its often proclaimed benefits.

Hayek associated a constant MV with monetary equilibrium. He didn’t think central banks could successfully target MV. For a time, that led him to consider both free banking and 100% reserve banking. Later, he preferred currency competition. I think it’s misleading to say he favored NGDP targeting.

I don’t see how any of the proposed monetary rules could be implemented under the current operating procedure. Beyond the administered interest rates it sets, I don’t see what the Fed can control.

Dear Jerry,

Thanks. I agree with you.

Many seem convinced the recession could have been avoided following a NGDP target.

I wanted to point to a case where NGDP grows along trend but results are not great. Taylor pointed out that there are several instances when a NGDP rule would have to be abandoned.

Andreas

Andreas, Just to be clear, I’ve been a critic of Turkey’s monetary policy for quite a while, it’s not even close to my preferred policy of 4% to 5% NGDP growth.

I’d add that your post presents no evidence that stable NGDP growth is associated with the sort of problems that market monetarists believe are generally associated with unstable NGDP growth. For instance, NGDP growth in America is usually adequate up until a recession begins (it’s not a leading indicator), and then falls during a recession (at the same time as RGDP.) Having said that, it wouldn’t surprise me if there was a bad outcome in Turkey, because real shocks are also extremely important in developing countries. Thus RGDP might fall without NGDP falling. But you have only provided a graph for NGDP levels (growth rates would be better), nothing else like employment, RGDP, etc. So your post doesn’t really establish that NGDP is inadequate in this case, as it’s quite possible that NGDP will also plunge over the next few quarters. It’s also possible that neither RGDP nor NGDP will plunge (although I think that less likely.)

Dear Scott,

thanks. Two responses:

1. 4-5% seems quite unrealistic in Turkey as you must know. It is an emerging market with high real growth rates. Inflation has been at 6-7% in good times. It is higher now.

2. I also believe that RGDP growth will fall. Unstable NGDP growth does signal trouble.

Armen Alchian said there is no such thing as macroeconomics. (I posted here on that quote.) He went on to explain that all economic causality is microeconomic. There are consequences for measured macroeconomic variables (GDP, etc.). But the causes are microeconomic.

If the causes are microeconomic, however, then Trying to manipulate macro variables will not be successful in offsetting undesirable macroeconomic consequences. I could call this the Alchian problem, but it is really the Hayek problem (which Alchian certainly recognized).

To connect to the current post, movements in NGDP growth may be associated with the business cycle. That neither means these movements are causative, nor that controlling NGDP growth (if that were possible) would moderate cyclical fluctuations.

In other words, correlation is not causality.

To be more specific, the collapse in real and nominal growth rates of variables during the Great Recession had real causes. By some analyses, and some evidence, there may have been a permanent effect on trend growth rates in real variables. (Capital was destroyed.) How manipulating (if that were possible) nominal macroeconomic variables could solve that real problem eludes me.

And, yes, I know about stickiness of nominal variables. But, again, as Alchian emphasized, nominal variable stickiness must be deduced from economic theory. Only then can we discover whether policy can influence economic decisions.

All of this was hashed out in Leijonhufvud’s book on Keynes, which was heavily influenced by both Alchian and Hayek (among many other influences, including, importantly, Hutt).

Jerry

Thanks, Jerry! I could not agree more.

Andreas, Those of us who favor NGDP targeting generally do not believe that the rate should depend on RGDP trend growth. Check out George Selgin’s “Less Than Zero”.

You haven’t provided any data on growth rates for NGDP in Turkey, or whether those rates have been stable over time. Just eyeballing the graph, NGDP growth looks too high in the past year. Excessive NGDP growth often presages a recession in the market monetarist model.

Jerry, There is an enormous amount of empirical evidence for a causal relationship between nominal shocks and the real economy. Mercatus will release another such study next month, but there are already a large number of such studies. (I’ve done empirical work on this, as have Friedman and Schwartz and many others.)

Hi Scott,

I was a bit surprised by your statement above when you wrote: “For instance, NGDP growth in America is usually adequate up until a recession begins (it’s not a leading indicator), and then falls during a recession (at the same time as RGDP.) ”

Can you please clarify, either here or (if you think it would be interesting for your fans) at one of your blogging locations? I realize why you are saying Andreas is wrong to point to Turkey as a counterexample (since real problems could lead to stable NGDP growth along with high price inflation and low real GDP growth). But, I don’t see how your statement above is consistent with your overall take on things.

Specifically, haven’t you been saying that the financial crisis and ensuing recession were due not to real factors, but to nominal factors? I thought you pointed to Fed tightness in 2007 (for example) as what actually “caused” the crisis, and continued Fed tightness as what made the recession happen.

Are you just saying that realistically, with the coarseness of the data etc., that we can’t really tease out the cause-and-effect relationship, that in practice we get the NGDP numbers the same time we get the RGDP numbers, and so you can’t really show that it’s tight NGDP growth that is causing slow RGDP growth?

Or are you saying something more fundamental? (Like maybe expectations are involved so even with daily reports of NGDP/RGDP they would appear simultaneous, but you would still say one “causes” the other?)

Scott,

I understand monetary disequilibrium theory. The point is that nominal shocks cause real changes. They cannot be corrected simply by reversing the nominal shock.

It would surprising if nominal and real magnitudes, like GDP, weren’t correlated. One includes the other.

I also share Bob Murphy’s confusion.

Thanks for the responses.

I graphed the data series I have seen plotted frequently for the Fed. I have just added a second graph below the original post including a benchmark. The focus on growth rates is not without issues. And I have got to come up with a number. Therefore, I took the 4 % growth rate typically suggested (but as a quarterly rate because we got Turkey here).