by Karl-Friedrich Israel and Gunther Schnabl

The ECB’s zero and negative interest rate policy continues despite the economic upswing. An interest rate hike is not expected before autumn 2019. The extensive purchases of government and corporate bonds will have reached €2,600 billion by the end of the year. The ECB’s financial market supervision as part of the Single Supervisory Mechanism (SSM), which was created in 2014 in response to the crisis, is proliferating. Most recently, ECB vice president Luis de Guindos has expressed the intention to monitor the investment fund sector.

Between 1999 and 2017, the ECB’s total annual expenditure rose from €132 million to €1,086 million. Since 2012, it expanded at an average annual rate of 12.4%. The cost of the ECB’s luxurious new building, amounting to €1.3 billion, is not included in these figures. As a share of the gross domestic product of the eurozone, the total operating expenses of the ECB have grown by 9.2% per year on average over the entire time span (Israel 2018).

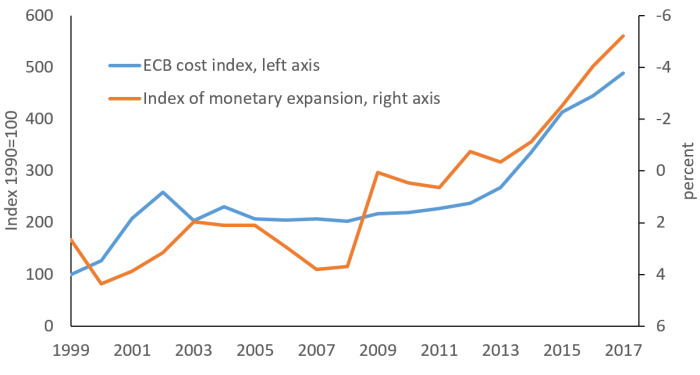

Staff and administrative costs, which account for over 90% of total expenditure, have risen by 19.2% per year since 2012. The number of full-time employees has more than doubled since 2012, from 1,638 to 3,384. Average staff costs per employee have increased from €83,364 in 1999 to €158,171 in 2017. This corresponds to 3.6% annually. As shown in the graph, the overall rise in costs is strongly correlated with the ECB’s interest rate cuts. But why is that?

ECB Monetary Expansion and Operating Expenses

Source: Wu and Xia (2017) and ECB Annual Reports. The index of monetary expansion corresponds to the ECB’s main refinancing rate until the onset of unconventional monetary policy. After that, measures of unconventional monetary policy are converted into interest rate cuts, so that the interest rate drifts strongly into the negative. The axis is inverted so that a rising line represents an increasing monetary expansion in the form of falling interest rates and asset purchase programs. The ECB’s costs are shown as a share of the eurozone’s gross domestic product.

The economic theory of bureaucracy by William Niskanen (1971) provides an explanatory approach. This theory assumes that administrative institutions want to maximize their budgets to increase their power, their prestige and the career opportunities of their employees. With the outbreak of the European financial and debt crisis, the ECB has indeed gained a central position in the supranational supervision of financial markets in the euro area. Since then, it has directly supervised the 120 largest banks in the euro area and indirectly most others.

At the same time, the ECB influences financial stability via its monetary policy. On the one hand, from 2008 to 2012 the ECB calmed down financial markets through extensive monetary expansion. On the other hand – just like from 2003 to 2007 during the period prior to the great crisis – the cheap money creates the potential for excessive credit growth (Schnabl 2017), which the ECB is now trying to prevent through more regulation and higher capital requirements for banks.

Moreover, the cheap money of the ECB is driving stock and real estate bubbles in the northern eurozone. The potential bursting of these bubbles requires additional regulatory measures to contain risk. As the tightening of regulation has hardly reduced this kind of risk, the ECB at least will be able to claim to have tried to contain the risk, once the bubbles have burst. Finally, ultra-loose monetary policy is depressing interest margins in traditional banking, which, together with the growing costs of regulation, is putting especially small and medium-sized banks in financial distress. The ECB tries to keep track of this process by means of comprehensive stress tests.

In short, while the ECB’s ultra-loose monetary policy creates major risks in the financial system, the ECB’s financial market supervision branch aims or pretends to contain these risks. The growing complexity of this regulation seems to justify not only more staff but also substantial wage increases. The ultra-loose monetary policy can thus also be seen as a major job creation program for central bankers. As European banks – in contrast to US banks – have not recovered since the crisis, the goal of creating financial stability has obviously not been achieved.

It is easy for the ECB to finance its growing expenditure. Other administrative institutions have to apply for a higher budget which has to be granted by some higher authorities, where every euro is being fought for due to scarce resources. In contrast, the ECB is not only politically but also financially independent. It can simply make use of the seigniorage profits from its monetary policy. So, it is no wonder that the ECB’s expenditure is going just as steeply upward as the interest rate is going downward and asset purchase programs are extended.

References:

Israel, Karl-Friedrich (2018): How cost-efficient is the Eurosystem? Working Paper. Available on SSRN.

Niskanen, William A. (1971): Bureaucracy and Representative Government, New Brunswick and London: Transaction Publishers

Schnabl, Gunther (2017): The Failure of ECB Monetary Policy from a Mises/Hayek Perspective. CESifo Working Paper 6388.

Wu, Jing Cynthia and Fan Dora Xia (2017): Time-Varying Lower Bound of Interest Rates in Europe, Chicago Booth Research Paper 2017-06. Data updated in 2018: https://sites.google.com/view/jingcynthiawu/shadow-rates

[…] Die Anzahl der EZB-Mitarbeiter hat sich seit 2012 mehr als verdoppelt, die operativen Kosten der Zentralbank sind explodiert. Dennoch scheitere die EZB beim Thema Finanzmarktstabilität, argumentieren Karl-Friedrich Israel und Gunther Schnabl. […]

The article was very well written Karl-Friedrich Israel, and Gunther Schnabl did a great job informing me about how the ECB is trying to create jobs for central bankers. They are doing what most companies are afraid to do, they say paying more helps their company more than paying them less. The chart backed up their comment which could help other companies in the future and expanding the companies.